You could be missing out on free money and not even know it.

If you're over 50, there are a bunch of underrated perks that can help cut your bills, shrink your insurance costs, and give your finances a solid boost.

We rounded up some of the best for 2025. Most are free or easy to claim, but they might not be around forever.

1. Get major discounts from top retailers.

Rite Aid Wellness 65+:

Get 5x points on select purchases the first Wednesday of every month, 10% off on Tuesdays, and a free consultation with a pharmacist. Signing up is free.

Goodwill:

Shoppers above a certain age can save 10–20% on select days, depending on location.

Kohl’s:

Every Wednesday, customers 60+ get 15% off in-store.

Walgreens:

Once a month, those 55 and up can take 20% off eligible, regular-price items. Dates vary by store.

Amazon Prime:

Discounted membership available for people on Medicaid, SSI, or other qualifying government programs - includes full Prime benefits at a lower monthly cost.

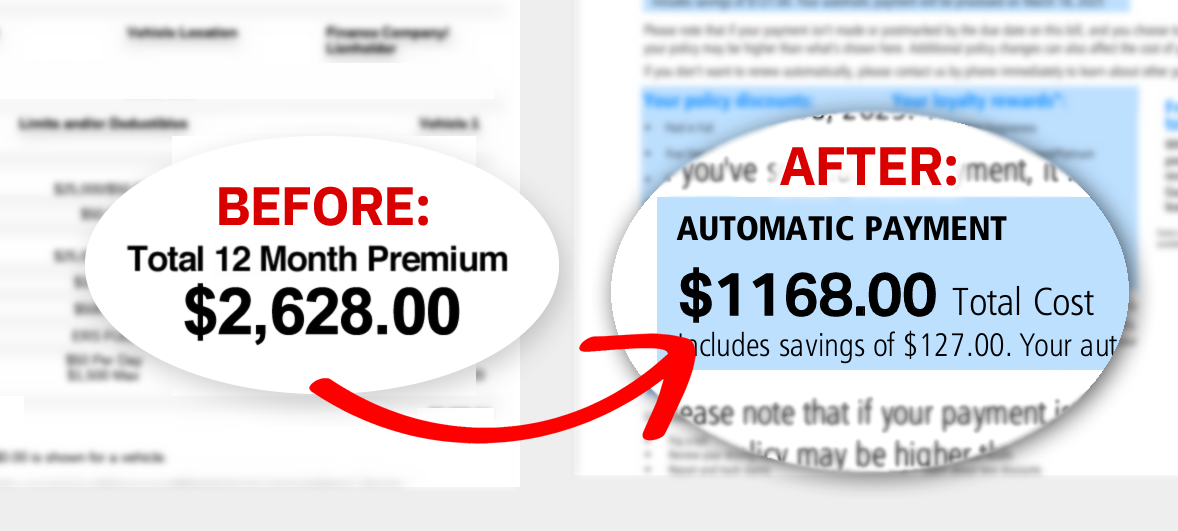

2. Switching car insurance companies can save you $460+/yr on average.

Believe it or not, the average American family still overspends by $461/year

¹ on car insurance. Drivers over 50 sometimes have access to special discounts, too.

I switched carriers last year and saved literally $1,300/year.

Here are screenshots of my bills before and after:

Here’s how to quickly see how much you’re being overcharged (takes maybe a couple of minutes):

Pull up a 3rd party comparison site (I like Coverage.com, but StopOverpaying.org is good too)

Answer the questions on the page (it took me around 90 seconds)

It’ll spit out a bunch of insurance options for you.

That’s literally it. You’ll likely save yourself a bunch of money.

Here’s a link to

Coverage.com

3. Tap into your home equity.

If you own your home but are low on cash, you might want to look into a HELOC (home equity line of credit). It’s more/less a credit card, but you borrow against your home’s equity.

They usually have lower interest rates and more flexible terms that a typical loan would.

Here’s a calculator you can use to see how much money you could access:

link.

4. Pay less at hotels and restaurants.

Best Western:

Guests 55 and older can get at least 10% off their room rate.

Denny’s:

Seniors 55+ can order from a special discounted menu. AARP members also get 15% off their total bill at select locations.

AMC Theatres:

Reduced ticket prices are available for seniors aged 60 and up.

5. Let other people pay for your home repairs.

Picture this: your trusty furnace suddenly throws a tantrum in the dead of winter, leaving you shivering and facing a repair bill that could cost you way more than you anticipated.

If you had a home warranty, you could be covered the next time something breaks down. It’s like having a safety net for your home (think plumbing, electrical, appliances, etc).

If you don’t have one yet,

Choice Home Warranty is one of the bigger companies out there.

Bonus: home warranty companies usually have qualified, pre-vetted maintenance and repair workers ready to get the job done (which is one less thing to worry about).

If you’re interested just

enter your zip code here to find a home warranty plan. It could save you a bunch of money the next time something breaks down.

6. Ask this company to pay off your credit card debt.

If you’ve got $10k+ in unsecured debt (think credit cards, medical bills, etc), you could use a debt relief program and potentially reduce it by around 23% (on average).

Here’s how to quickly see if you qualify for debt relief:

Simple as that. You’ll likely end up paying less than you owed and could be debt free in 24-48 months.

Here’s a link to

National Debt Relief.

7. Get access to better prices on Amazon and other large retailers.

You might be surprised how often you’re overpaying on Amazon and elsewhere.

Big stores like Amazon know that no one has time to price shop through dozens of sites, so there’s often no incentive for them to offer bargain prices.

I typically hate browser extensions with a fiery passion, but if you don’t have

Capital One Shopping installed yet, do yourself a favor and grab it.

When you shop online (on Amazon or elsewhere) it will:

Auto-apply coupon codes to potentially help save you money

Compare prices from other sellers to help make sure you’re not missing out on a better deal

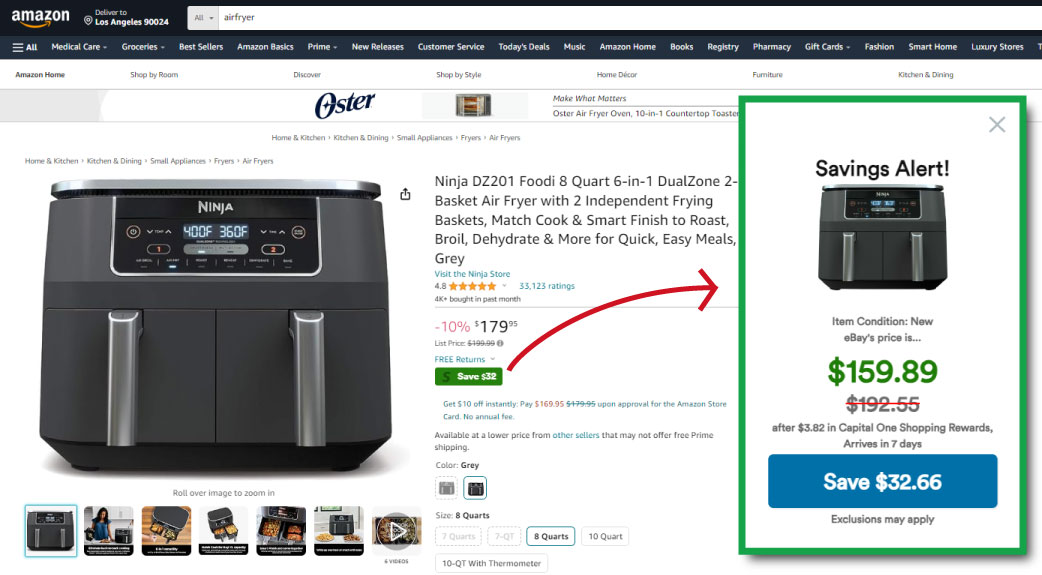

Here’s a quick example of how it works:

Savings will vary, this is just an example, of course.

Whenever the extension finds an available discount, you’ll see a little savings alert pop-up. For example, here you can save $32 on this air fryer.

Here’s a link to install

Capital One Shopping, if you’re interested.

8. Let someone else manage your finances for you.

Most people don’t have a financial advisor, and it’s typically a huge mistake.

Sure, you can manage things on your own if you want to, but most people don’t have the time to actually do things right. There are huge benefits to having somebody pay attention to your money all the time.

People with financial advisors tend to beat the market by ~3%/year (according to a 2019 Vanguard Study). That can make a huge difference over time.

But more important: a good advisor will handle ALL of the annoying retirement stuff & bizarro tax implications you would have never thought of

If you don’t know a financial advisor personally, use a comparison site (like

Datalign) and find somebody near you that has good reviews.

Or if you want something easier,

here’s a quiz you can fill out that can find an advisor/planner based on your reqs.

9. Cut your travel expenses.

Greyhound:

Travelers 62+ get 5% off fares, including on cross-border trips.

Amtrak:

Seniors 65 and up can save 10% on most train tickets.

National Park Service:

U.S. citizens and permanent residents aged 62+ can buy a lifetime Senior Pass for $80, giving access to 2,000+ federal recreation areas.

T-Mobile 55+ Plan:

T-Mobile’s 55+ plan saves you about $10/month and includes free Netflix, Hulu, and Apple TV+ (with ads).

10. Block almost all ads on your computer (before they have a chance to load).

If you aren’t using an ad blocker yet, I am begging you to try one. I am not exaggerating when I say it will change your life.

A good ad blocker will eliminate virtually all of the ads you’d see on the internet.

No more YouTube ads, no more banner ads, no more pop-up ads, etc. It’s incredible.

Most people I know use Total Adblock (

link here) – it’s $2.42/month, but there are plenty of solid options.

Ads also typically take a while to load, so using an ad blocker reduces loading times (typically by 50% or more). They also block ad tracking pixels to protect your privacy, which is nice.

Here’s a link to

Total Adblock, if you’re interested.

11. You likely qualify for cheaper home/renter's insurance.

Switching home insurance will often save you more than switching auto policies (I've heard of people saving $1k per year by switching).

Here's the home insurance comparison site I typically use:

link.

12. Reduce your monthly bills.

I'd suggest using something like

BillChecker.org once a month or so. It's a site that asks you questions about your bills, etc., and it tries to find ways to save you money.

It typically takes 30 seconds or so, and is pretty effective (no contact info required either, which is nice). You might be surprised how often you’re unknowingly overpaying for things.

Here’s a

link.

13. Stop paying your credit card company.

If you’re stuck with credit card debt, you feel it. The high interest, the endless payments, the sinking feeling that you’re never getting ahead.

And let’s be honest—your credit card company isn’t on your side. It’s making a fortune off you with interest rates that can hit 36%. But

Bankrate could help you escape the cycle.

They let you compare personal loan options from multiple lenders to find the best rates. If you owe $100,000 or less, you could get a lower-interest loan to pay off your balances—fast.

The upside? You’ll have just one monthly payment. And because personal loans typically come with lower rates (

Bankrate lenders offer options as low as 6.70% APR), you’ll get out of debt sooner. Plus, no credit card bill this month.

You don’t need perfect credit to check your options, and looking won’t hurt your score.

Bankrate has been helping people find the best loan rates for decades—it’s one of the most trusted names in the industry.

It takes less than 2 minutes to compare your options. No Social Security number required, just a real phone number (but don’t worry—they won’t spam you).

14. Don't skip even bigger age exclusive discounts (for just $16/year).

You’ve probably heard of

AARP, but here’s something I didn’t know until recently: you don’t have to be over 50 to join. While a few perks are reserved for the 50+ crowd, there are still plenty of benefits worth checking out.

They offer discounts on a ton of stuff - dining, travel, gas, groceries, entertainment, etc. So if you like saving money (who doesn’t?), it’s worth checking out.

Membership is ~$16/year, but if you make the most of their offers, it pretty much pays for itself.

Plus, they have some solid resources and tools that can come in handy for things like managing finances or planning for the future.

Not saying it’s for everyone, but if you like getting a good deal, it might be worth a look. Head to their site

here.

15. Get on this list and save up to $1,000+ a year.

The internet is huge, which means there are amazing money-making opportunities that pop up almost every day.

But most of them expire or sell out so fast that the public doesn’t have a chance to hear about them.

For example: back in September, there was a company offering $2,500/month for someone to literally watch shows on Netflix. Unsurprisingly, the role was filled so fast before most people knew it existed.

What if you could get access to great deals/money-making opportunities before other people do?

I spend every day looking for great ways to save/earn money, and whenever I find something really lucrative, I send out a text to our Betterbuck VIPs list first. (You can join it below, it’s 100% free)

It’s a great way to get tips about time-sensitive opportunities and deals before the rest of the country has time to hear about them.

You can join the list here:

National Debt Relief

- Reduces debt by 23% on avg.

- Could be debt free in 24-48 months

- For people with $10,000+ in unsecured debt