I’ve talked to a lot of people who I would consider to be pretty smart, and still somehow making some pretty questionable money decisions.

It’s surprisingly common - overcomplicating things, missing the obvious, or just putting off the boring financial stuff for way too long.

Here are the most common (and dumbest) mistakes I see, and how to fix them before they cost you more.

1. Overpaying for car insurnace (by $450+/year).

Believe it or not, the average American family still overspends by $461

¹ on car insurance.

(Sometimes it’s significantly more: I saved $1,300/year when I switched)

Here’s how to quickly see how much you’re being overcharged (takes maybe a couple of minutes):

Pull up Coverage.com – it’s a free site that will compare offers for you

Answer the questions in their quiz (takes maybe 90 seconds or so).

It’ll spit out a bunch of insurance offers for you.

That’s literally it. You’ll likely save yourself a bunch of money.

Here’s a link to

Coverage.com

2. Paying off credit card debt on your own (when some companies are willing to help).

If you’ve got $10k+ in unsecured debt (think credit cards, medical bills, etc), you could use a debt relief program and potentially reduce it by around 23% (on average).

Here’s how to quickly see if you qualify for debt relief:

Simple as that. You’ll likely end up paying less than you owed and could be debt free in 24-48 months.

Here’s a link to

National Debt Relief.

National Debt Relief

- Reduces debt by 23% on avg.

- Could be debt free in 24-48 months

- For people with $10,000+ in unsecured debt

3. Not using your home equity to get cash.

If you own your home but are low on cash, you might want to look into a HELOC (home equity line of credit). It’s more/less a credit card, but you borrow against your home’s equity.

They usually have lower interest rates and more flexible terms that a typical loan would.

Here’s a calculator you can use to see how much money you could access:

link.

4. Paying for home repair bills out of pocket (when a company can pay them for you instead).

Picture this: your trusty furnace suddenly throws a tantrum in the dead of winter, leaving you shivering and facing a repair bill that could cost you way more than you anticipated.

If you had a home warranty, you could be covered the next time something breaks down. It’s like having a safety net for your home (think plumbing, electrical, appliances, etc).

If you don’t have one yet,

Choice Home Warranty is one of the bigger companies out there.

Bonus: home warranty companies usually have qualified, pre-vetted maintenance and repair workers ready to get the job done (which is one less thing to worry about).

If you’re interested just

enter your zip code here to find a home warranty plan. It could save you a bunch of money the next time something breaks down.

5. Not getting a financial advisor.

One of the best things you can have in a financial crisis is a great advisor.

95% of people don’t have an advisor, and it’s typically a huge mistake.

There are huge benefits to having somebody pay attention to your money all the time:

People with financial advisors tend to beat the market by ~3%/year (according to a 2019 Vanguard Study). That can make a huge difference over time.

But more important: a good advisor will handle ALL of the annoying retirement stuff & bizarro tax implications you would have never thought of

If you don’t know a financial advisor personally, use a comparison site (like

FinancialAdvisor.net) and find somebody near you that has good reviews.

Or if you want something easier,

here’s a quiz you can fill out that will find an advisor/planner based on your reqs.

6. Paying credit card interest payments.

High-interest credit card payments can be a nightmare. Have you ever wished you could just take a break from them?

You actually might be able to. Many people may not know, but there's a great way to avoid interest payments for over a year or more.

It's called a

balance transfer. In simple terms, you move your balance to a new credit card that offers a 0% intro APR for a set period of time, which could help you save on interest.

If you're interested, here are a few great balance transfer cards to look into:

link here.

7. Paying for subscriptions you don’t use.

We’ve all signed up for free trials and forgotten to cancel them. Stop paying for services you aren’t using!

Take a minute and get yourself a good cancellation app: I like Rocket Money (

link here).

It’s an app that will put together a list of your subscriptions so you can pick/choose which ones to cancel.

They also have a premium service that will cancel them for you, if you’d like.

Here’s a link (it’s free).

8. Not getting paid for your screentime.

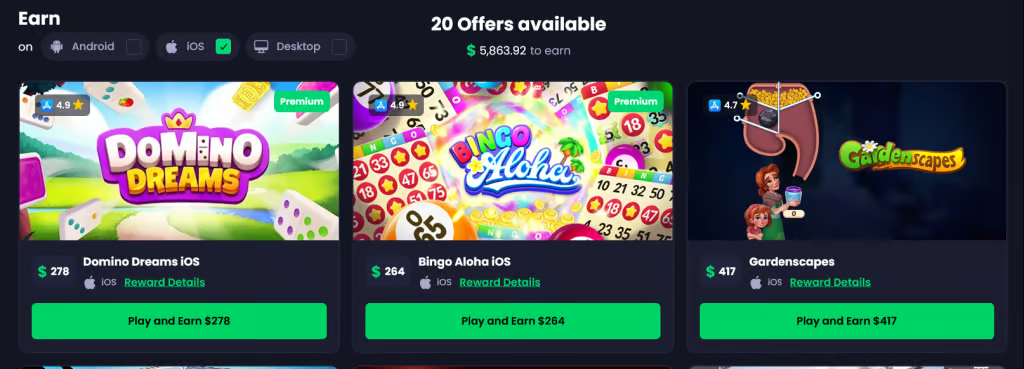

Apps like

Freecash will pay you to test new iOS/Android games on your phone.

Some games pay as much as $350 to testers. Here are a few examples right now (from

Freecash‘s homepage):

You don’t need any kind of degree or any prior experience: all you really need is a smartphone (Android or IOS).

If you’re scrolling on your phone anyway, why not get paid for it?

I’ve used

Freecash in the past – it’s solid. They also gave me a $5 bonus instantly when I installed my first game, which was nice.

9. Not using an ad blocker.

If you aren’t using an ad blocker yet, you are missing out.

A good ad blocker will eliminate

virtually all of the ads you’d see on the internet.

No more YouTube ads, no more banner ads, no more pop-up ads, etc.

Most people I know use Total Adblock (

link here) – it’s $2.42/month, but there are plenty of solid options.

Ads also typically take a while to load, so using an ad blocker reduces loading times (typically by 50% or more). They also block ad tracking pixels to protect your privacy, which is nice.

Here’s a link to Total Adblock, if you’re interested.

10. Paying your credit card company.

If you’re stuck with credit card debt, you feel it. The high interest, the endless payments, the sinking feeling that you’re never getting ahead.

And let’s be honest—your credit card company isn’t on your side. It’s making a fortune off you with interest rates that can hit 36%.

So how do you escape the vicious cycle? Look into getting

a personal loan.

How it works: you take out a “personal loan” and use that loan to pay off your high-interest credit cards all in one fell swoop.

Then you’re just left with one single payment, and that payment usually has a lower rate than your high-interest CC debt did.

If you’re interested, here’s a free 3rd party site you can use to see if a personal loan could work for you:

Bankrate.com

They let you compare personal loan options from multiple lenders to find the best rates.

The upside? You’ll have just one monthly payment. And because personal loans typically come with lower rates (Bankrate lenders offer options as low as 6.70% APR), you’ll get out of debt sooner. Plus, no credit card bill this month.

You don’t need perfect credit to check your options, and looking won’t hurt your score.

It takes less than 2 minutes to compare your options. No Social Security number required, just a real phone number (but don’t worry—they won’t spam you).

Here’s a link to their site.

11. Not having a solid cash back credit card (when you could earn up to 5%, depending on what you buy).

If you’re dealing with credit card debt, a 0% intro APR credit card could give you some much-needed relief. It’s actually a smart way to tackle your balances without the added weight of interest slowing you down.

On top of that, these credit cards offer an impressive up to 5% cash back on qualifying purchases.

Whether you’re in the midst of paying off debt, or just looking for a smarter way to shop, these cards are pretty great options. You might be surprised at just how much you can actually save,

check it out here.

12. Missing out on huge discounts.

You’ve probably heard of

AARP, but here’s something I didn’t know until recently: you don’t have to be over 50 to join. While a few perks are reserved for the 50+ crowd, there are still plenty of benefits worth checking out.

They offer discounts on a ton of stuff – dining, travel, gas, groceries, entertainment, etc. So if you like saving money (who doesn’t?), it’s worth checking out.

Membership is ~$16/year, but if you make the most of their offers, it pretty much pays for itself.

Plus, they have some solid resources and tools that can come in handy for things like managing finances or planning for the future.

Not saying it’s for everyone, but if you like getting a good deal, it might be worth a look.

Head to their site here.

13. Not getting on this list (you could save up to $1,000+ a year).

The internet is huge, which means there are amazing money-making opportunities that pop up almost every day.

But most of them expire or sell out so fast that the public doesn’t have a chance to hear about them.

For example: back in September, there was a company offering $2,500/month for someone to literally watch shows on Netflix. Unsurprisingly, the role was filled so fast before most people knew it existed.

What if you could get access to great deals/money-making opportunities before other people do?

I spend every day looking for great ways to save/earn money, and whenever I find something really lucrative, I send out a text to our Betterbuck VIPs list first. (You can join it below, it’s 100% free)

It’s a great way to get tips about time-sensitive opportunities and deals before the rest of the country has time to hear about them.

You can join the list here:

National Debt Relief

- Reduces debt by 23% on avg.

- Could be debt free in 24-48 months

- For people with $10,000+ in unsecured debt